The Finance Bill of 2022 has introduced a new section in the Income-Tax Act of 1961, known as 194S. This section mandates the deduction of 1% Tax Deducted at Source (TDS) on any consideration paid for the transfer of Virtual Digital Assets (VDA). It is important to note that cryptocurrencies are categorized as Virtual Digital Assets (VDA). Therefore, the transfer of cryptocurrencies will be subject to the 1% TDS as per the provisions outlined in the Income Tax Act.

TDS Deduction:

At Bitcoiva, we ensure a seamless tax compliance process for our users. When you execute a trade on our platform, we take care of the Tax Deducted at Source (TDS) deduction on your behalf. The deducted TDS amount is then transferred to the Income Tax Department in the form of Indian Rupees (INR).

TDS is applicable in the following scenarios:

- Selling in the INR/Crypto market.

- Buying or selling in the Crypto/Crypto market.

- Selling in the Peer-to-Peer (P2P) market.

| Markets | Crypto/INR | Crypto/Crypto | P2P |

| Order Type | Buy Sell | Buy Sell | Buy Sell |

| TDS Rate | NA 1% | 1% 1% | NA 1% |

It’s important to note that TDS is not levied when you make a purchase in the INR/Crypto market. We aim to provide a transparent and hassle-free trading experience while ensuring compliance with tax regulations.

Note: In accordance with Section 206AB of the Income-Tax Act, 1961, a revised provision has been introduced. If a user has not filed their Income Tax Return for the past two consecutive years and the total amount of Tax Deducted at Source (TDS) is ₹50,000 or more in each of those two preceding years, the TDS deduction rate for Crypto-related transactions will be set at 5%. This provision aims to encourage timely tax compliance and ensure proper reporting of income from cryptocurrency transactions.

TDS Tracking:

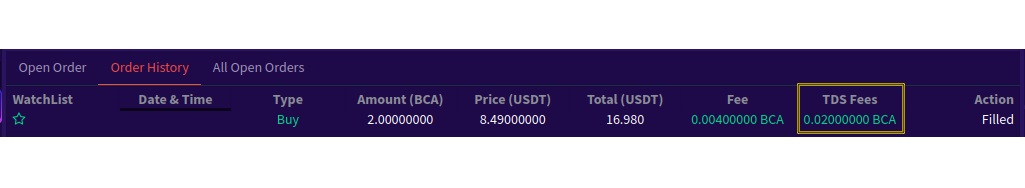

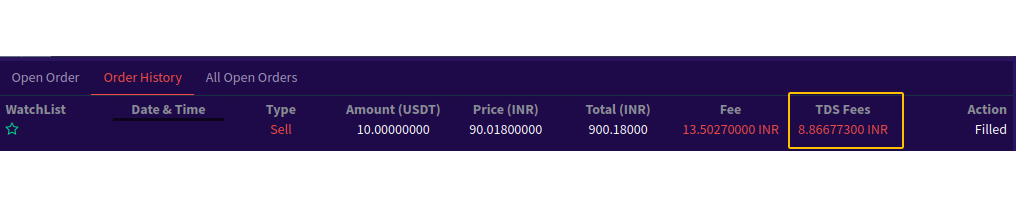

To track the Tax Deducted at Source (TDS) for a specific trade, simply navigate to your completed order history on our platform. Locate the trade you wish to review and select it. Within the trade details, you will find the TDS deduction amount clearly displayed. This allows you to easily monitor and keep track of the TDS deducted for each trade you have executed.

FAQs raised by the Bitcoiva customers

What is 1% TDS?

TDS stands for Tax Deducted at Source. It is a tax collection mechanism where the deductor (in this case, crypto exchanges like Bitcoiva) deducts Tax from the transaction amount on behalf of the taxpayer and remits it to the government. The 1% TDS refers to the rate at which the Tax will be deducted from crypto transactions.

How is TDS calculated?

The TDS calculation is straightforward. It is computed as 1% of the transaction value. For example, if the transaction amount is ₹10,000, the TDS deducted will be ₹100 (1% of ₹10,000).

How will TDS be deducted from Crypto-INR pairs?

In the case of selling a crypto asset for INR, Bitcoiva will deduct 1% TDS from the total transaction amount. For instance, if you sell a crypto asset for ₹50,000, 1% TDS amounting to ₹500 will be deducted. Bitcoiva will then deposit this deducted amount with the Income Tax Department on the seller’s behalf. Additionally, a TDS certificate will be issued to the seller in due course.

How will TDS be deducted from Crypto-Crypto pairs?

When it comes to crypto-crypto pairs, both parties involved in the trade are considered sellers of a crypto asset. Therefore, a 1% TDS will be deducted from both sides. Let’s consider an example: if a trade on the BTC/USDT pair involves selling 0.1 BTC for 2000 USDT, both the buyer and the seller will have 1% TDS deducted from the respective crypto assets they will receive. To illustrate, the buyer will have 0.001 BTC (1% of 0.1 BTC) and 20 USDT (1% of 2000 USDT) deducted as TDS. The crypto deducted as TDS will be converted to INR at the end of the day, and the resulting INR amount will be paid as TDS to the government. Bitcoiva will handle all the necessary TDS operations for trades executed on its platform.

What does the 1% TDS mean for Bitcoiva customers?

The 1% TDS will be automatically deducted from the transaction amount when you sell your crypto assets on Bitcoiva. This deduction will be by the taxation guidelines set by the authorities.

Why is Bitcoiva implementing the TDS?

Bitcoiva is committed to upholding its stated principles and ensuring a hassle-free tax experience for its customers. By implementing the TDS regime, we aim to streamline the taxation process and ensure compliance with tax regulations in the crypto space.

How will the TDS impact my transactions?

The TDS will only apply to the transaction amount and not the profits you make. It means that 1% of the total transaction value will be deducted at the time of sale, ensuring compliance with tax regulations.

Will the TDS affect my profitability on Bitcoiva?

No, the TDS will not directly impact your profits. It is a deduction made on the transaction amount, not the profits generated from your crypto investments.

Visit us at: www.Bitcoiva.com