Once you have successfully registered in Bitcoiva, here: Register

Login to your account here: Login

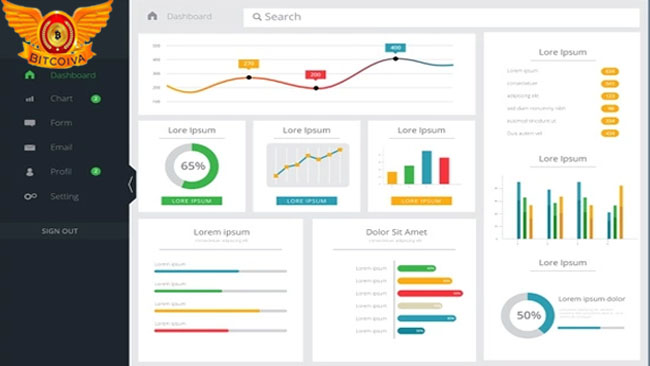

dashboard

In the dashboard, the customer’s total portfolio value is displayed in BTC, USD, and INR. Cryptocurrency India, BTC means Bitcoin, USD means united state dollar, and INR means Indian rupee. The currency in the customer account will be displayed in these three kinds of currencies.

Bank transfer

The bank transfer is classified into three ways INR balance, USDT balance, and INR inter-user transfer. The amount deposit and withdrawal are done accordingly to the type of bank transaction taking place.

INR balance

Deposit: The deposit in INR balance takes place in two methods instant transaction and standard transaction.

Instant transaction

Deposit: In this, the customer has to enter the account number, IFSC code, and type of banking. Then the customer must enter the amount they want to deposit.

Withdraw

Balance: The overall balance of the customer will be shown, including the amount in the account and the amount allotted for buying.

Withdraw amount: The customer has to enter the amount they want to withdraw from the account.

Withdraw bank: The customer has to enter the bank details from which they want to make the withdrawal.

Withdraw password: The customer has to enter the withdraw password correctly that they have created before.

Two-factor authentication: The customer must enable the two-factor authentication to withdraw the amount from their account; they have to enter the passcode sent to their registered phone number.

Email OTP: The customer has to enter the OTP sent to their email id.

The minimum amount for withdrawal is 10, 00000 to a maximum of 50, 00000.

Standard transaction: It involves two methods Fiat and crypto

- Fiat

Select currency: The customer has to choose the type of currency they want to deposit their amount in, there will be many options in currency the customer has to choose the currency they want on the crypto app India.

Deposit type: There are four types of deposits available they are Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT), and Real-Time Gross Settlement (RTGS). The customer can also deposit using Real-Time Gross Settlement (UPI).

Select account: The customer has to enter the account from which they want to deposit the amount. If the customer is using only one account there is no need for them to change the account, but if the customer is using more than one account they have to select the correct account they are willing to deposit the amount.

Transaction id: The customer should enter the correct transaction id they want to make a deposit in and if they enter the wrong id the transaction will b denied.

Deposit amount: The customer has to enter the correct amount they want to deposit to the account.

Upload receipt: The customer should upload the image of the receipt they have done the transaction on for the purpose of verifying the transaction if.

Submit: After completing the whole process the customer should click on submit to complete the transaction.

Transaction history: In transaction history, one can find the complete transaction details they have done so far.

- crypto

Select currency: The customer has to choose the type of currency they want to deposit their amount in, there will be many options in currency the customer has to choose the currency they want.

Transaction details: In transaction details, one can find the complete transaction details they have done so far.

Withdraw fees: The customer is charged 10rs per transaction

USDT balance

Deposit: The deposit in USDT balance takes place in two methods instant transaction and standard transaction.

Wallet deposit on Crypto exchange India

Select currency: The customer has to choose the type of currency they want to deposit their amount in, there will be many options in currency the customer has to choose the currency they want; there are a total of 174 currencies available in USDT.

Transaction details: The customer has to enter their bank transaction details to process the transaction.

Select network: The customer has to select any one of the networks from the given 3 types of network. They are Tron (TRC20), binance chain (BEP2), and etherum (ERC20).

Bank transfer fiat

Select currency: The customer has to enter the amount in united state dollar (USD) to deposit the amount where 1 USD is equal to 76 rs in INR

Select account: The customer has to enter the account from which they want to deposit the amount. If the customer is using only one account there is no need for them to change the account, but if the customer is using more than one account they have to select the correct account they are willing to deposit the amount.

Transaction id: The customer should enter the correct transaction id they want to make a deposit in and if they enter the wrong id the transaction will b denied.

Deposit amount: The customer has to enter the correct amount they want to deposit to the account.

Upload receipt: The customer should upload the image of the receipt they have done the transaction on for the purpose of verifying the transaction if.

Submit: After completing the whole process, the customer should click on submit to complete the transaction.

Transaction history: In transaction history, one can find the complete transaction details they have done so far, the fees charged a customer is 2%.

Withdraw

Withdraw bank: The customer must enter the bank details from which they want to withdraw.

Withdraw password: The customer has to enter the withdraw password correctly that they have created before.

Two-factor authentication: The customer must enable the two-factor authentication to withdraw the amount from their account; they must enter the passcode sent to their registered phone number.

Email OTP: The customer has to enter the OTP sent to their email id.

INR inter user transfer

Inter user transfer is a transaction done between two different accounts of the same customer. That is if a customer has two accounts the customer can transfer the amount from one account to the other accounting cryptocurrency Exchange India.

Transfer

Username: The user should enter the permanent username they created in registration.

Amount: The customer has to enter the correct amount they want to transfer to the account.

Withdraw password: The customer has to enter the withdraw password correctly that they have created before. The minimum amount to withdraw is 100 rs to 10 crores.

Redeem

Redeem code: The customer has to enter the redeem code given to the customer.

Withdraw password: The customer has to enter the withdraw password correctly that they have created before.

Spot

The spot is a pie chart representation of the balance available in the customer account; there are totally four colors used in the pie chart. Each color represents BTC, INR, and USDT, AND ALTCOINS. When the customer touches any one of the colors it will show which currency it is representing. The maximum color in the charts represents the highest currency value in the balance amount.

Lending

Lending is a pie chart representation of the balance currency available in the customer wallet. There are totally four colors used in the pie chart. Each color represents the value of currency available in the customer’s wallet. When the customer touches any one of the colors it will show which currency it is representing. The maximum color in the charts represents the highest currency value in the balance amount.

visit us on: www.bitcoiva.com