Introduction

Staying ahead of the curve is essential for successful crypto trading in the dynamic world. If you are looking for the best cryptocurrency exchange in India and to analyze the trends in the marketplace, you have reached a better destiny. Here, we will go through the numerous steps to make informed decisions and make your trading without risk.

Understanding Market Trends

To analyze the crypto market, you have to stay updated on the news, events, and developments in the crypto environment. Trends can be bullish or bearish, and they can range from short to long-term fluctuations.

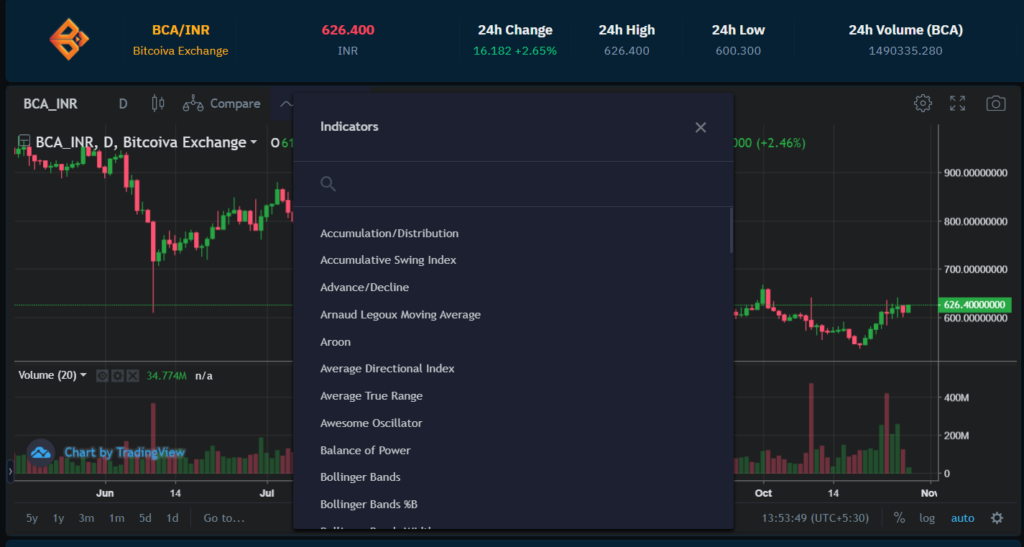

Utilizing Technical Analysis

Technical analysis involves studying price charts and using various indicators to predict future price movements. Mostly, the technical analysis relies on the historical price movement of the trading pairs. The above market trends can be observed using the price charts and indicators. One of the most popular tools is the moving average, which produces a single flowing line. The golden cross in the moving averages signals a bullish trend while it crosses above the long-term moving averages. Considerably, the death cross indicates a possible bearish trend. Learn how to use tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands that make your trading strategy work.

Fundamental Analysis

Fundamental analysis is a factor that affects the value of the cryptocurrency in the market. It play a vital role in choosing the best cryptocurrency exchange in India. The factors of the fundamental analysis involve understanding the whitepaper of the particular currency, team credentials, partnerships, and community engagement. For example, if a crypto token has a strong partnership with a reputable company, it can boost the prices in long-term profits.

Sentiment Analysis

Sentimental analysis is the most important factor that heavily impacts the crypto factor. These factors are often reflected in social media and news. The sentiment analysis tool can guess the overall mood in the cryptocurrency market. For example, the greed and fear index shows the percentages of sentiments that fell on fear or greed in the crypto markets. Peaks in the greed index show bullish sentiment, while the peak in the fear index shows a potential downtrend, indicating bearish and negative sentiment. Intermediately, it shows a neutral sentiment, neither bearish nor bullish. These collective indexes allow you to make informed decisions for your trade.

Risk Management

Successful crypto traders optimize risk management strategies to diversify their portfolios. The risk management strategies include limit orders and stop/loss to protect the capital investments.

Finding the best crypto trading platforms

Reliable exchange is at the forefront of all the above trading analysis. You will probably maintain a great portfolio in the great crypto markets. The vast range of factors in choosing the best crypto trading platforms includes security, fees, user experience, and the available crypto pairs.

Putting It All Together

If you have analyzed the market trends and the best crypto exchange app, now it is your time to apply your knowledge and shine in your investment goals. Create your own strategy and diversify your crypto portfolio.

Conclusion

Finally, analyzing crypto market trends is not a short-term process but it is a continuous learning process. Now, you will be better equipped with the marketing trends, utilizing technical and fundamental analysis to make informed decisions about the best cryptocurrency in India. Always remember that patience and discipline are the key strategies to be successful in the crypto portfolio.

Visit us at: www.bitcoiva.com