One of the most amazing engineering achievements to occur in the cryptocurrency sector is the Ethereum Merge. The Merge will change the Proof-of-Work consensus method used by the Ethereum blockchain to a Proof-of-Stake consensus mechanism, marking the culmination of many years of study, engineering, and development.

In many ways, this incident may be compared to changing the engine of a $191 billion jet while it was flying at full speed and carrying hundreds of billions of dollars’ worth of financial infrastructure.

Officially planned to occur at a Total Terminal Difficulty of 58.75e21, the Merge executed on September 15, 2022. This report will profile the performance of the Beacon Chain since the genesis block on December 1, 2020, and will present a number of new indicators to assist understand the Crypto Indian Exchange, that supports Ethereum Proof-of-Stake system as the Merge date approaches.

Block Participation and Production

Compared to a comparable Proof-of-Work chain, the Beacon Chain’s block manufacturing method involves a few more phases. In a PoW system, miners are in charge of creating blocks. They then broadcast their successful blocks to a network of nodes, which confirms that the contained transactions and block template comply with the consensus requirements.

The following steps involves in block production and validation in the Ethereum PoS system:

The PoS blockchain make up a set of slots that happen on average every 12 seconds.

Each slot is a chance for a validator to construct and suggest a block.

Each consecutive block of 32 slots (6.4 minutes) categorizes as an epoch.

The protocol creates a committee for each Epoch out of a set of 128 validators.

An algorithm choose one member of this committee to Propose a Block for the forthcoming Slot.

The committee’s remaining validators offer Attestations that the proposed block and its included transactions adhere to the consensus guidelines.

The remaining two-thirds of the validator network then go about methodically finalizing epochs.

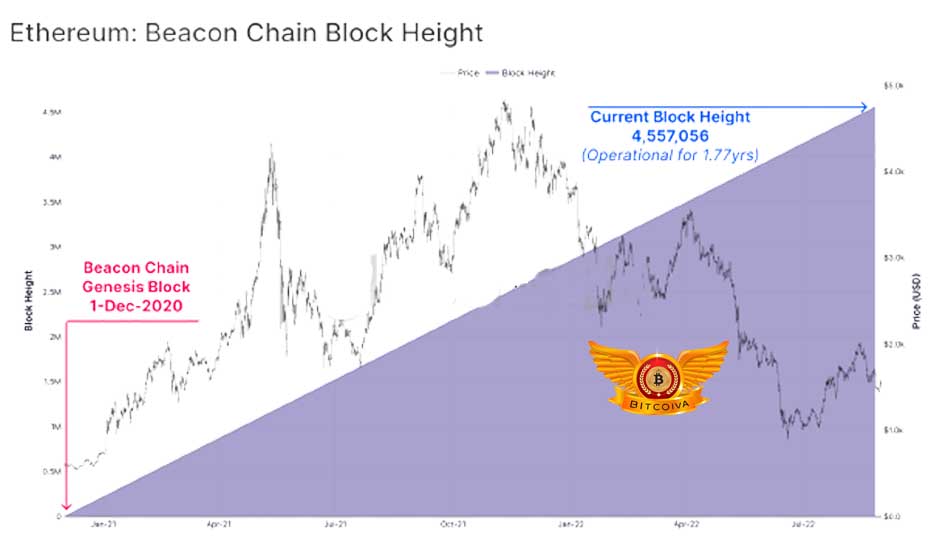

Beacon Chain’s genesis block occurred on December 1, 2020. And as of this writing, the new network has been running for 639 days (or 1.77 years). Block height 4,557,056 and epoch height 142,408 have surpassed by the chain-tip.

Ethereum Beacon Chain Block Height

You might consider each slot as a potential location where a block could form. The slot deems to Miss if the validator choses for block production becomes unavailable or fails to successfully propose a block. Only 0.908% of the total slots have been missed thus far, or a total of 41,389 slots.

Other times, a block is disapproved by the attesting validators or causes a fork to happen by accident. Orphan blocks are those that the majority of the network did not follow. And they provide an alternative version of block history. On the Beacon Chain 5,017 orphan blocks have been created, taking up only 0.110% of slots.

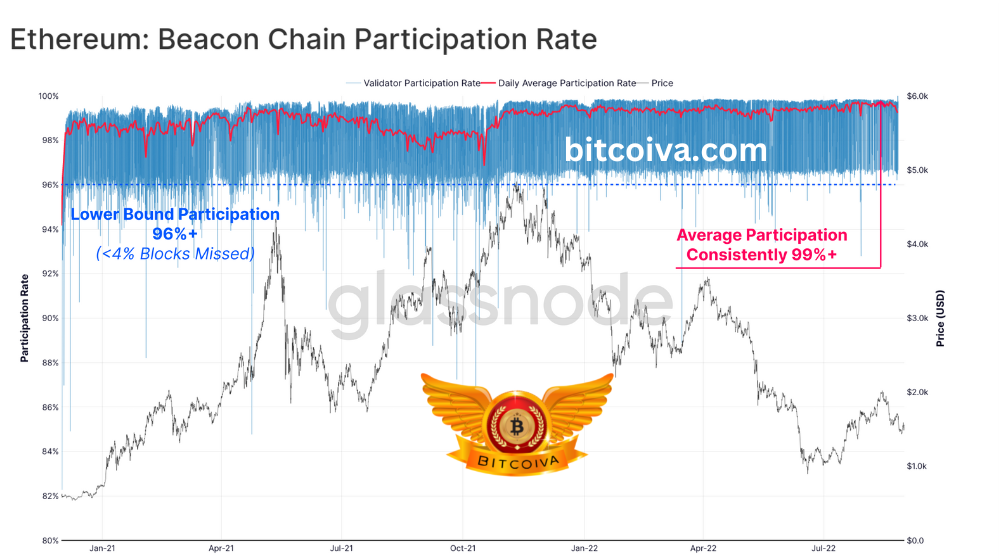

We may also count the total number of validator committee attestation votes cast in support of the generated blocks. Each attestation essentially acts as a “yes” vote to add the most recent proposed block at the blockchain’s tip.

We should anticipate a steady daily attestation count of between 783k and 914k. It should be with an average slot interval of 12 seconds and 127 attesting validators. In fact, since August 2021, the overall number of attestations per day has stabilized in this range, at about 800,000.

Validators Take Over for Miners

Validators, who must stake 32 ETH to participate in protocol consensus, take the position of miners in the Most Trusted Cryptocurrency Exchange In India, Ethereum PoS consensus system. Earlier in November 2020, the Ethereum Beacon Chain deposit contract became live, enabling early adopters to deposit ETH and kick-start the Beacon Chain.

Phase 0 of the Beacon Chain roadmap was the first step. To produce the Genesis block, a minimum of 524,288 ETH had to be deposited in the deposit contract. The deposits were (and still are) one-way, and that until the Shanghai upgrade, which is presently estimated to be completed 6 to 18 months after the Merge, ETH could not be withdrawn from the deposit contract from the Cryptocurrency Buy In India.

Although deposits were initially hesitant to begin, the Phase 0 Threshold was firmly reached on November 24, 2020, a week before the anticipated genesis date, thanks to a sharp increase in community confidence.

Validator Revenue and Performance

Firstly to begin a validating, validators must first deposit a stake of 32 ETH. If their balance goes below 16 ETH, they remove from the protocol. After joining the protocol, a validator’s total ETH balance will start to fluctuate for a variety of reasons, including:

1.Revenue earned from fees and issuing (balance increase)

2.If validators frequently miss blocks or attestations, activity may leak (balance decreases).

3.In the case of malicious behavior, slashing (balance decreases).

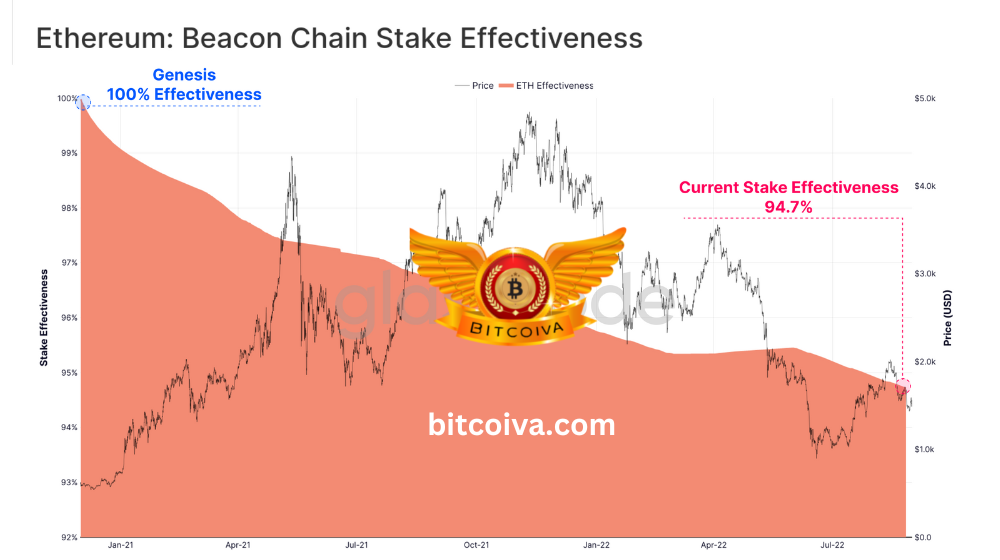

Another idea is termed Effective Balance, which has an upper limit of 32 ETH and a lower limit of 1 ETH increments. This is with a minimum buffer of 0.25 ETH. For example:

1.A staker’s Effective Balance (green) is 32 ETH even if their Total Balance (red) is 32.5 ETH after receiving rewards of 0.5 ETH.

2.The Effective Balance (green) rounds down to 31 ETH if a staker has 32 ETH but loses 0.5 ETH due to an inactivity penalty, changing their Total Balance (red) to 31.5 ETH.

3.The Effective Balance will be 31 ETH for a Total Balance of 31.250 ETH.

4.An effective balance of 30 ETH will result from a total balance of 31.249 ETH.

Ethereum Beacon Chain Stake Effectiveness

We can also look at the money the total validator pool has made thus far. India’s Largest Crypto Exchange, supports various cryptos, and Ethereum PoS consensus, the issuance rate is partially based on the amount of ETH staked. Meaning that the per validator payout decreases as more individuals stake.

As a result, the annualized average ETH revenue has decreased from 3.65 ETH/yr at genesis to 1.42 ETH/yr as of right now. Given that the deposit contract is mainly one-way. The growing amount of staked ETH over the past 18 months is mostly to blame for this reward dilution.

Accordingly, the yield on a 32 ETH investment expressed in annualized ETH has decreased. Falling from over 15% at genesis to just 4.44% now. Investors will probably take solace in the successful upgrade after the merger. In which it will result in more deposits, which will further reduce this yield.

Bottom Line

The Ethereum Merge, the product of extraordinary engineering and research efforts over many years, is rapidly approaching in the Cryptocurrency Exchange India. In this research, we looked at the basic workings of Ethereum’s new Proof-of-Stake consensus algorithm and how to analyze the Beacon Chain’s network performance. We evaluated the Beacon Chain’s performance up to this point and characterized validator deposits, revenue sources, and potential effects on the dynamics of the net ETH supply.

It signifies a huge vote of confidence from the Ethereum community. That is more than 11.2% of the circulating supply of ETH is currently participating in PoS consensus. We can anticipate a successful main-net Merge and future analysis of the innovative and intriguing Proof-of-Stake consensus method.

Visit us on: www.bitcoiva.com