Among individuals who do not want to trade manually, grid trading in crypto regarded as one of the most popular crypto trading strategies. However, automating it is rather easy and, in the correct market conditions, can generate significant rewards. Let’s study more about this concept in this article.

What is Grid Trading in Crypto

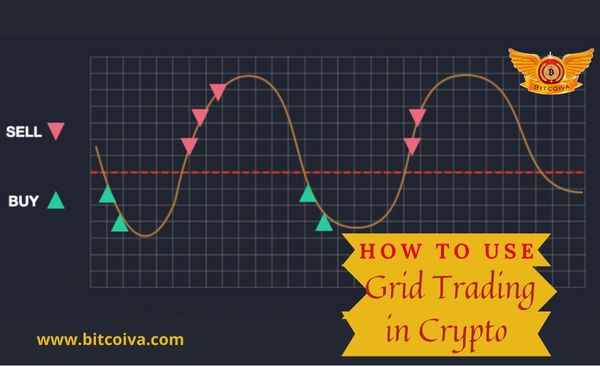

Grid trading in crypto is the process of placing orders above and below a predetermined price, resulting in a grid of orders at progressively higher and lower values. Grid trading is most frequently related to the crypto market. The overall goal of the approach is to profit from an asset’s usual price volatility by placing buy and sell orders at specific, regular intervals above and below a base price.

It is a system that partially automated: You manually set up a grid. The stress of trading techniques that need the trader to manually open and end positions therefore eliminated by employing buy and sell stop orders, which functions somewhat like an automated strategy.

It is well-liked in erratic markets: This system’s ability to present investment opportunities in the face of fluctuating market situations is another fantastic feature. In doing so, it does away with the necessity to forecast the course of the market. The technique will handle the rest; all the trader has to know is when the market will move.

Investment Opportunities in Hot Markets

This approach used to trade on multiple instruments.

Although these advantages might sound appealing, it’s crucial to understand that nothing can ever guaranteed. You must understand how to correctly implement the technique in order to manually create a grid trading strategy that works. You must be aware of:

How the Market Operates

Fundamentals

Prevailing industry trends

Trading commissions and margin charged by a broker.

Utilizing a broker with fair trading commissions is crucial. The grid trading system’s maximum levels will constrained by these circumstances. The drawback of the grid trading crypto technique is that it requires the trader to constantly be aware of the available margin, especially in trending markets.

In order to offset the risk you will create for the broker, you must deposit margin with your broker. This is sometimes expressed as a proportion of your open trading positions. Margin thought of as a deposit for open trades, which is a useful analogy.

To make your grid stronger, it can be useful to know how to utilise additional trading techniques and indicators. Using the Average True Range (ATR) indicator to create an ATR grid trading system, for instance, or Gann lines to create a Gann grid trading method. I’ll go into more depth about this later.

The buy stop order and sell stop order placed at various intervals above and below defined price in the crypto grid trading strategy in an effort to capitalise on the market’s natural movement. This is frequently referred as a double grid trading method because levels are set on both sides.

Grid

You can design your grid to capitalise on trends or ranges. For instance, a trader can make buy orders every 15 pip above and below the predetermined price, as well as sell orders every 15 pip in the opposite direction. This will benefit from current trends.

They might also put purchase orders below the predetermined price and sell orders above it to profit from a market that is trading in a range.

The idea behind a trend-based grid trading technique is that if the market price goes continuously in one direction, your position to profit from it expands. The grid activates more purchase orders when the price rises, increasing your position. If the price moves in this direction, your position will increase and become more profitable.

However, this puts traders in a difficult situation. At some point, the trader must choose when to shut down the grid, close out all of their open positions, and take their gains. Your profits could eventually disappear if the price turns around. Your sell orders, which are similarly spaced apart, will limit your losses. However, your position can have already changed from a profit to a loss by the time the price hits those orders and they are triggered.

The Five Key Parameters for Grid Trading in Crypto

Grid trading bots typically require comparable parameters, whether they are built-in on exchanges or available as software downloads. These settings are manually entered by traders into their bot. The key variables in grid trading to comprehend are as follows:

The maximum bitcoin price you decide to establish for your deal is known as the “take-profit.” The grid will automatically sell all positions if the price of the cryptocurrency hits this level, and the profit will be deposited in USDT or another stablecoin in your account.

Stop-Loss

The price at which you automatically exit a trade when it falls below that level. The stop loss will be activated and you will be forced to exit your position at a loss if the price falls below this level.

Upper Limit

Your grid’s upper limit is its maximum price. Above this threshold, the bot won’t place sell orders. Your potential for profit increases with the height of your upper limit.

Lower Restriction

The grid’s lower pricing limit is known as the lower limit. Below this threshold, the bot won’t place buy orders. The lower limit frequently exceeds the stop loss by a small amount.

Grid Number

The grid numbers represent the most buy and sell orders that can be placed in your grid.

If you choose a grid number of 10, you will have 5 purchase orders and 5 sell orders because the orders are evenly spread.

Here are some hypothetical grid trade parameters based on the previously mentioned BTC/USDT pair’s 5-minute chart:

Maximum: 62,000 USDT

Minimum: 60,000 USDT

Grid position: 8

$10,000 total investment

BTC price right now: 60,998.54 USDT

The price is where all open positions are. Because we selected an eight-square grid, we must now choose eight automated buy and sell limit orders (four of each type). We can modify our grid to reflect the fact that the price will fluctuate between 60,000 USDT and 62,000 USDT at this location.

When do Grid Trades Close

A wise trader understands when to take profits and close a position. To reduce the danger of liquidation should the markets move against your position, taking a profit is crucial. When you’re happy with the gains you’ve made across the board, closing is the best course of action.

Is Grid Trading in Crypto Successful

Instead of focusing on each individual deal inside the grid, consider the grid as a whole. Set grid profitability goals, such as 5 or 10 percent, and stop trading when you’ve reached them.

Putting the crypto Grid System in place

The creation of a manual grid trading technique is demonstrated here. This can also be regarded as a double grid trading method, as I described previously.

Plan when both sell and buy orders are executed. However, if the price moves in just one direction, you’ll need a stop loss to protect yourself. The trader will be able to exit their position and collect their profits if the price stays erratic, triggering both buy and sell orders without trending in one direction and triggering the stop loss. It’s a good idea to keep in mind that trading involves a lot of risk and could lead to a loss.

Visit us on: www.bitcoiva.com