Introduction to Bitcoin Dominance

Bitcoin holds the world’s largest market capitalization and has the most significant trading volume in the global cryptocurrency market.

It occupies the most significant market cap valuation space in cryptocurrency.

Bitcoin dominance is defined as the ratio between the market cap of Bitcoin and the rest of the altcoins in the cryptocurrency markets.

Bitcoin dominance was far away for many years, but it dropped significantly while the altcoin, such as ICO, ETH, etc.

Bitcoin season is often called altcoin season, in which the altcoins gain their value in the market share. Consider that the bear and bull markets do not directly affect Bitcoin, but it is a ratio and not an absolute term.

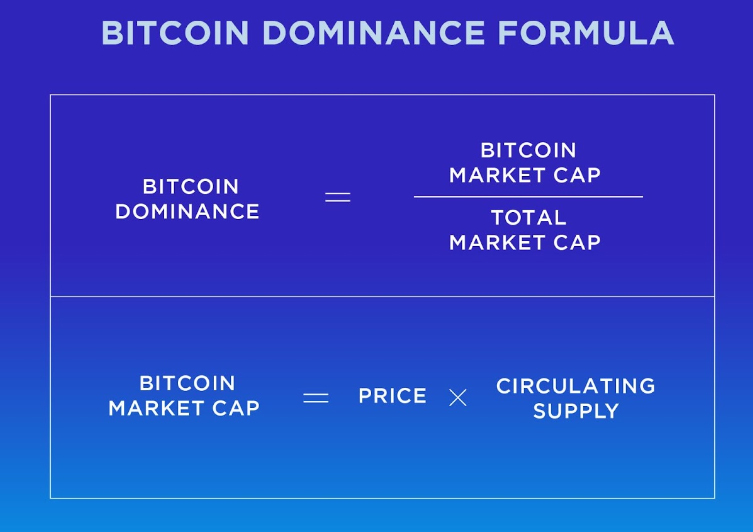

How to Calculate Bitcoin Dominance?

Bitcoin Dominance = Bitcoin (BTC) market capitalization ÷ All other cryptocurrencies.

Bitcoin dominance is the percentage calculation between the total BTC market capitalization and all other cryptocurrencies’ market capitalization in the current market.

For example, consider the total market cap is 100 million USD, and the Bitcoin market capitalization is 70 million USD, then apply the formula, we can get the result of 70% as Bitcoin Dominance.

Factors Affecting Bitcoin Dominance

There are multiple factors affecting Bitcoin’s Dominance in the market.

The Bitcoin dominance goes down if the traders move towards altcoins. Some of the popular altcoins may have a substantial impact on influencing the traders and had significant uptrends for that altcoins.

Another factor that affects Bitcoin’s Dominance is the use of stablecoins in the market. Stablecoin might see a significant uptick in volume for the time being. The Traders can invest in the stablecoin, which is an easy way to on-ramp funds into the crypto industry.

Also, whenever new altcoins enter the market, there is a result of thousands of dollars flowing alongside the newly entered altcoins.

Finally, the above factors could impact the Bitcoin price will be dropped and rebounded quickly.

Bitcoin’s Dominance was over 90% before the altcoins entered the market. But, it is unexpected to hit that number again in the market. Bitcoin Dominance will also expect to rise again while the countries following El Salvador implement Bitcoin as legal tender.

How Crypto Traders Use Bitcoin Dominance?

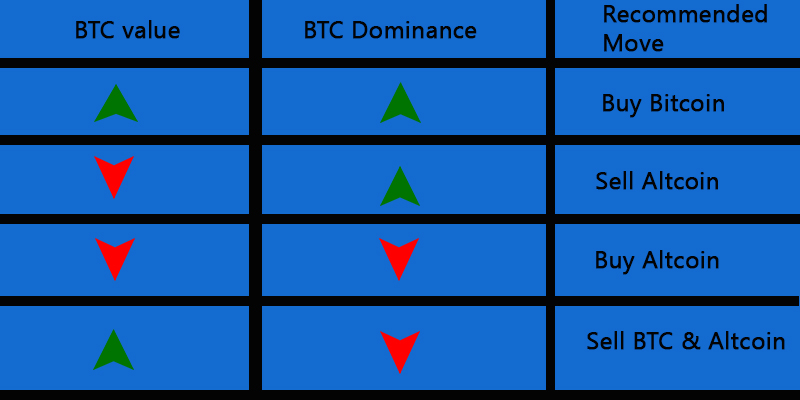

Traders also use BTC Dominance as an indicator to decide between buying/selling cryptocurrencies.

There are four standard moves among traders to decide between buying/selling a cryptocurrency.

- If the Bitcoin value and the BTC dominance index raises, the traders recommend buying BTC.

- If the BTC value decreases and the BTC dominance index increases, it is considered the potential altcoin bear market; the traders recommended selling altcoins.

- If the BTC value increases and the BTC dominance index decreases, it is considered the potential altcoin bull market, and investors tend to buy altcoins.

- If both the Bitcoin and BTC dominance values decrease, it is a potential bear market; the investors recommend selling Bitcoin and possible altcoins.

In conclusion, Bitcoin dominance is not only the tool/indicator to sell/buy specific cryptocurrencies. There are many more indicators and tools to predict uptrends and downtrends; it is better to examine them before making a trade.

Visit Us at: www.bitcoiva.com