Introduction

If you’ve been following cryptocurrencies for a while, you’ve probably heard people saying things like “The bull market is back!” or “We’re in a crypto bull run!”

But what exactly does that mean?

In simple terms, a bull market refers to a phase in the financial market where prices are rising or are expected to rise over a sustained period. When applied to cryptocurrencies, a crypto bull market (or bull run) means that the prices of digital assets like Bitcoin, Ethereum, and other coins are continuously increasing, often driven by optimism, high demand, and investor enthusiasm.

This guide breaks down everything you need to know about a crypto bull market: what causes it, its different phases, how to identify one, and how to make smart decisions during this exciting period.

What Is a Crypto Bull Market?

A crypto bull market (also called a bull run) is a period when the overall cryptocurrency market experiences significant price growth. During this time, investor confidence is high, media coverage is positive, and most digital currencies show upward trends.

Unlike short-term price spikes, a bull market lasts for months or even years. For example, the 2020–2021 crypto bull run saw Bitcoin rise from around $10,000 to nearly $69,000, while altcoins like Ethereum and Binance Coin hit all-time highs.

In traditional finance, a 20% price increase from the recent market bottom is considered the beginning of a bull market. However, in crypto, due to higher volatility, this number can vary greatly.

Why Do Bull Markets Happen in Crypto?

Several factors combine to create a crypto bull market. Let’s look at some of the most common ones:

1. Increased Demand and Adoption

As more people, businesses, and institutions start using or investing in cryptocurrencies, demand grows. This drives prices upward. For instance, when large institutions like Tesla or MicroStrategy announced Bitcoin purchases, the market responded with massive optimism.

2. Bitcoin Halving Events

Bitcoin’s halving (which occurs every four years) reduces the reward miners receive for adding new blocks. This event decreases the supply of new Bitcoin entering the market, creating scarcity, which often triggers a bull run.

3. Positive Market Sentiment

News coverage, social media buzz, and general excitement can drive more people to buy crypto, leading to a cycle of rising demand and higher prices, a phenomenon known as FOMO (Fear of Missing Out).

4. Technological Advancements

The launch of new technologies, upgrades (like Ethereum’s transition to Proof of Stake), and innovative sectors such as DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) also attract attention and capital, fueling growth.

5. Favorable Economic Conditions

Global economic policies, low interest rates, or inflation concerns may push investors to seek alternative stores of value, and crypto often benefits as a result.

Phases of a Crypto Bull Market

Crypto bull markets often follow predictable phases. Understanding these can help investors recognize where the market stands and make smarter decisions.

1. Accumulation Phase

This is the early stage following a bear market. Prices are relatively stable, and confidence begins to return slowly. Experienced investors (often called “smart money”) start accumulating assets while the general public remains cautious.

2. Growth Phase

Momentum begins to build. Prices start climbing steadily, attracting attention from analysts and investors. Trading volume increases, and optimism grows stronger.

3. Euphoria Phase

This is the heart of the bull run. Prices rise rapidly, new investors flood the market, and even lesser-known coins gain huge attention. Social media and mainstream news buzz with crypto success stories.

However, this phase also comes with high risk, as the market may become overvalued.

4. Correction and Distribution Phase

After months of massive gains, prices start to fluctuate and may fall sharply as investors take profits. Market sentiment shifts from excitement to caution, signaling that the bull run may be losing strength.

How to Identify a Crypto Bull Market

Spotting a bull market early can be tricky, but several signs can help you identify one:

| Indicator | What It Means |

| Rising Prices Across the Market | Major coins like Bitcoin and Ethereum break past key resistance levels and reach new highs. |

| High Trading Volume | Increasing daily trade volume shows more investor participation and buying interest. |

| Growing On-Chain Activity | More wallet addresses, transactions, and active users indicate market strength. |

| Positive News Coverage | More mainstream attention and institutional announcements boost sentiment. |

| Altcoin Season | When Bitcoin stabilizes and investors move profits into altcoins, many smaller tokens rally, a sign of strong bull momentum. |

| Fear & Greed Index in “Greed” Zone | A popular indicator that measures market emotion, extreme greed often accompanies strong bull markets. |

Examples of Past Crypto Bull Runs

2017 Bull Run

- Peak: Bitcoin reached an all-time high of $19,783 in December 2017.

- Key Drivers:

- ICO Boom: The surge in Initial Coin Offerings (ICOs) attracted significant investment into the crypto space.

- Media Hype: Extensive media coverage fueled public interest and speculative investments.

- Retail FOMO: Fear of missing out led to a rush of retail investors entering the market.

- ICO Boom: The surge in Initial Coin Offerings (ICOs) attracted significant investment into the crypto space.

- Outcome: The rapid influx of new investors led to unsustainable price levels, culminating in a sharp correction in early 2018.

2018 Bear Market

- Decline: Bitcoin’s price fell by about 65% from January to February 2018.

- Contributing Factors:

- Regulatory Concerns: Increased scrutiny and regulatory actions in major markets dampened investor enthusiasm.

- Market Overheating: The 2017 bull run was driven by speculative investments, leading to a market bubble.

- Security Breaches: High-profile hacks and scams eroded trust in the ecosystem.

- Regulatory Concerns: Increased scrutiny and regulatory actions in major markets dampened investor enthusiasm.

- Result: A prolonged bear market ensued, lasting until early 2020.

2020–2021 Bull Run

- Catalysts:

- COVID-19 Pandemic: Global economic uncertainty led investors to seek alternative assets.

- Institutional Adoption: Companies like MicroStrategy and Tesla began adding Bitcoin to their balance sheets.

- DeFi and NFTs: The rise of decentralized finance and non-fungible tokens attracted new participants.

- Bitcoin Halving: The May 2020 halving reduced the supply of new bitcoins, increasing scarcity.

- COVID-19 Pandemic: Global economic uncertainty led investors to seek alternative assets.

- Outcome: Bitcoin and other cryptocurrencies reached new all-time highs, with Bitcoin peaking at $69,000 in November 2021.

2022–2023 Bear Market

- Decline: Following the 2021 peak, the market experienced a significant downturn.

- Factors:

- Regulatory Crackdowns: Increased regulatory actions in key markets like the U.S. and China.

- Market Corrections: The overvaluation from the previous bull run led to a natural market correction.

- Macro-Economic Factors: Rising interest rates and inflation concerns reduced liquidity.

- Regulatory Crackdowns: Increased regulatory actions in key markets like the U.S. and China.

- Result: A prolonged bear market persisted, testing investor sentiment.

2024–2025 Bull Run

- Initiation:

- ETF Approvals: The approval of Bitcoin and Ethereum ETFs in major markets facilitated institutional investment.

- Regulatory Clarity: Clearer regulatory frameworks provided a safer environment for investors.

- Macroeconomic Factors: Economic uncertainties and inflation concerns drove interest in alternative assets.

- ETF Approvals: The approval of Bitcoin and Ethereum ETFs in major markets facilitated institutional investment.

- Current Status: As of October 2025, Bitcoin’s price has surpassed $126,000, with significant inflows into crypto ETFs.

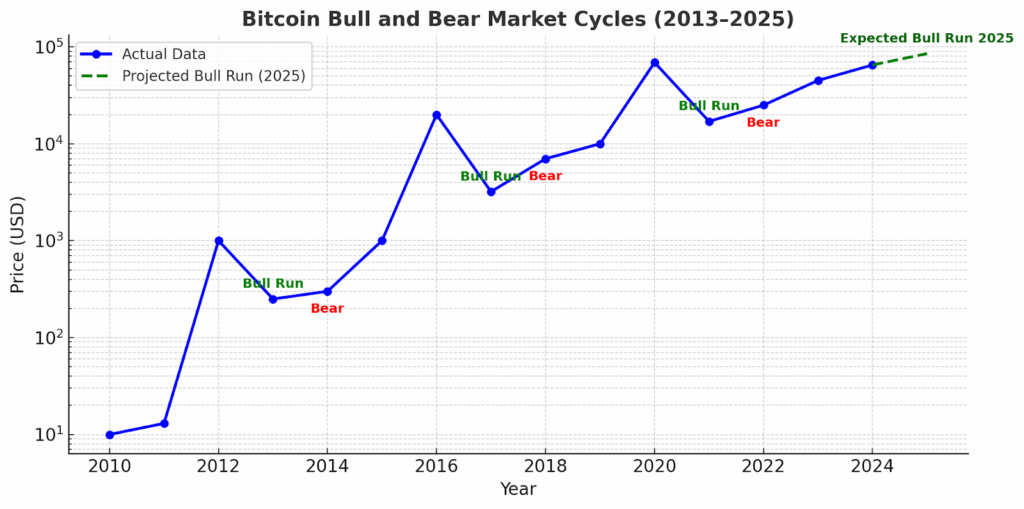

Example Chart: Bitcoin Bull Market Cycle

Here’s a simple illustration showing Bitcoin’s previous bull and bear cycles:

Each peak represents a bull market top, often followed by a bear market before the next cycle begins.

How to Stay Safe During a Bull Run

While bull markets offer great profit opportunities, they also come with risks. Here’s how to stay cautious:

- Avoid FOMO Investing – Don’t rush to buy coins just because prices are rising.

- Take Partial Profits – Secure your gains gradually instead of waiting for the top.

- Diversify Your Portfolio – Invest across different cryptocurrencies and avoid betting everything on one coin.

- Beware of Scams – Bull markets attract fake projects and rug pulls. Always research before investing.

- Plan for Taxes – Remember that crypto gains may be taxable, depending on your country.

- Keep a Long-Term View – Focus on the fundamentals and real-world value of projects.

Conclusion

A crypto bull market or bull run is one of the most exciting times in the digital asset world. Prices surge, investor confidence grows, and opportunities for profit are everywhere. However, just like any financial market, it’s essential to stay disciplined, manage risk, and understand that no bull run lasts forever.

By learning to identify market phases, following sound investment strategies, and staying calm during volatility, beginners can make the most out of a bull market, without falling into emotional traps.

Visit: www.bitcoiva.com