What is USDT Staking?

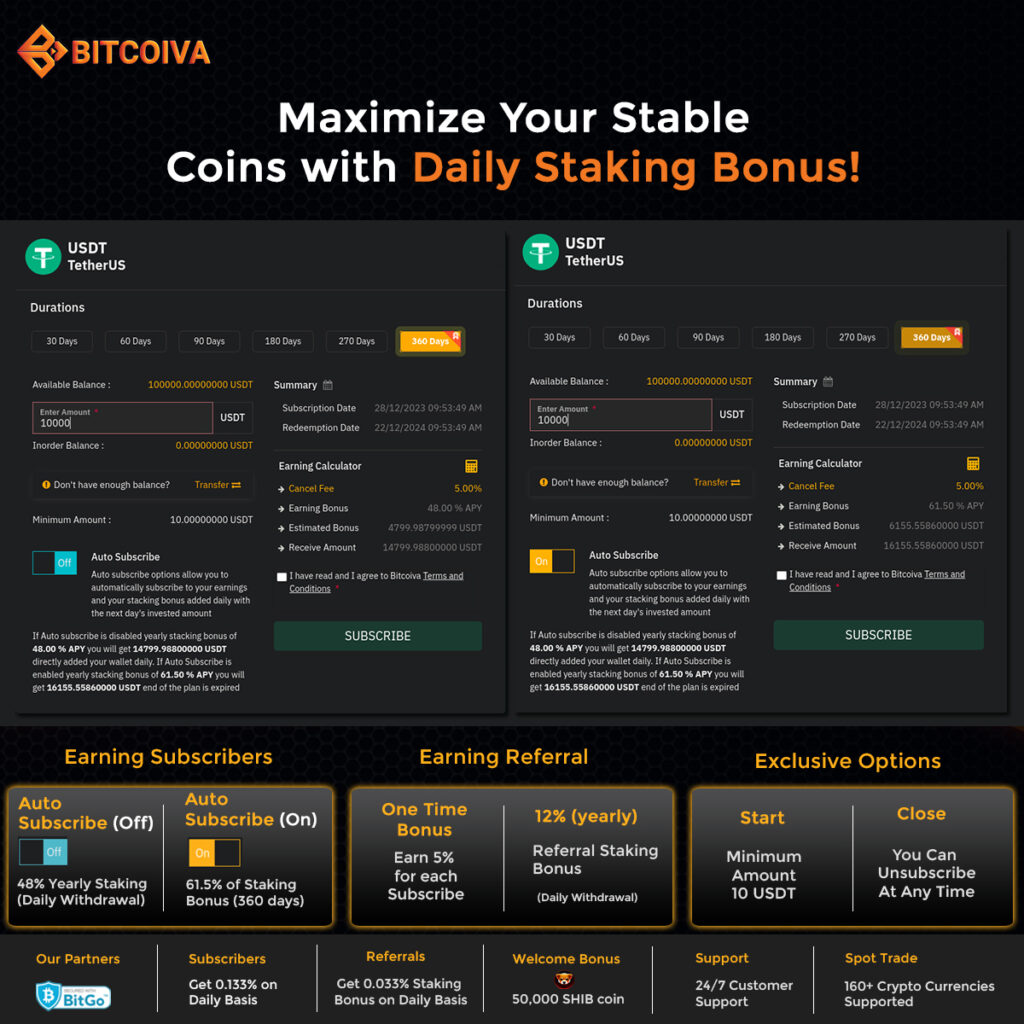

USDT staking is a way of earning rewards, bonuses, or interest for staking USDT. Bitcoiva, the top usdt staking platforms in India offers the highest percentage of interests for staking usdt from 48% to 61.5% APY.

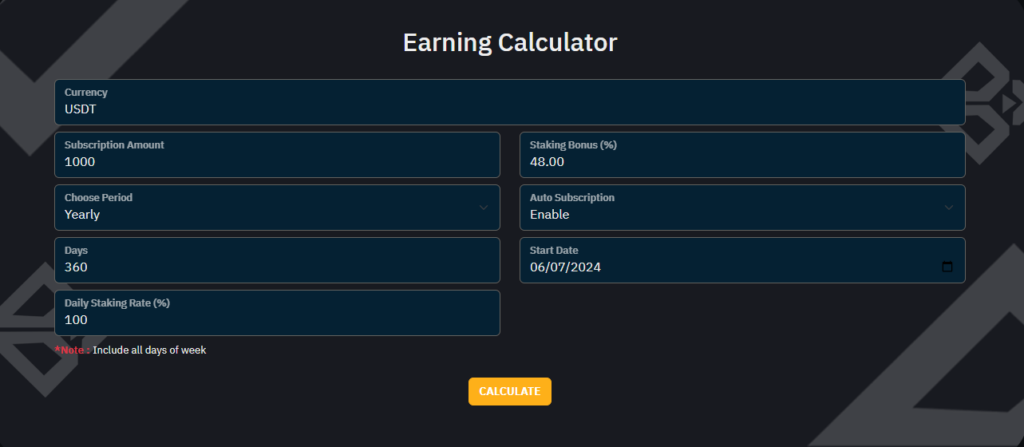

Bitcoiva offers Earnings calculator that allows you to calculate the percentage of earnings for the staking of Usdt for Daily/Monthly/360 days.

How do you earn interest on USDT in Bitcoiva?

By subscribing to the USDT 360 Days Plan, users can benefit from 48% to 61.5% of the staking Bonus and referral rewards.

Bitcoiva offers two ways for USDT Earnings.

Auto-Subscription Off:

Earn a Staking Bonus of 48% with 0.133% of daily withdrawals added to the next day’s staking Bonus.

Auto-Subscription On:

Earn a Staking Bonus of 61.5% at the end of 360 days.

For Referrals: Earn 0.33% of Daily Withdrawals added to the next day’s staking Bonus.

How usdt staking plan works on Bitcoiva?

Auto-Subscription Off

Staking Bonus of 48% for $ 10,000

| Month | Earning Per Month | Total Earnings | Total Yield |

| — | — | $ 10,000.00 | |

| 1 | $ 400.00 | $ 400.00 | $ 10,400.00 |

| 2 | $ 400.00 | $ 800.00 | $ 10,800.00 |

| 3 | $ 400.00 | $ 1,200.00 | $ 11,200.00 |

| 4 | $ 400.00 | $ 1,600.00 | $ 11,600.00 |

| 5 | $ 400.00 | $ 2,000.00 | $ 12,000.00 |

| 6 | $ 400.00 | $ 2,400.00 | $ 12,400.00 |

| 7 | $ 400.00 | $ 2,800.00 | $ 12,800.00 |

| 8 | $ 400.00 | $ 3,200.00 | $ 13,200.00 |

| 9 | $ 400.00 | $ 3,600.00 | $ 13,600.00 |

| 10 | $ 400.00 | $ 4,000.00 | $ 14,000.00 |

| 11 | $ 400.00 | $ 4,400.00 | $ 14,400.00 |

| 12 | $ 400.00 | $ 4,800.00 | $ 14,800.00 |

Auto-Subscription Off

Staking Bonus of 48% for $ 100,000

| Month | Earning Per Month | Total Earnings | Total Yield |

| — | — | $ 100,000.00 | |

| 1 | $ 4,000.00 | $ 4,000.00 | $ 104,000.00 |

| 2 | $ 4,000.00 | $ 8,000.00 | $ 108,000.00 |

| 3 | $ 4,000.00 | $ 12,000.00 | $ 112,000.00 |

| 4 | $ 4,000.00 | $ 16,000.00 | $ 116,000.00 |

| 5 | $ 4,000.00 | $ 20,000.00 | $ 120,000.00 |

| 6 | $ 4,000.00 | $ 24,000.00 | $ 124,000.00 |

| 7 | $ 4,000.00 | $ 28,000.00 | $ 128,000.00 |

| 8 | $ 4,000.00 | $ 32,000.00 | $ 132,000.00 |

| 9 | $ 4,000.00 | $ 36,000.00 | $ 136,000.00 |

| 10 | $ 4,000.00 | $ 40,000.00 | $ 140,000.00 |

| 11 | $ 4,000.00 | $ 44,000.00 | $ 144,000.00 |

| 12 | $ 4,000.00 | $ 48,000.00 | $ 148,000.00 |

Auto-Subscription On

Staking Bonus of 61.5% for $ 10,000

| Month | Earning Per Month | Total Earnings | Total Yield |

| 0 | – | – | $ 10,000.00 |

| 1 | $ 407.83 | $ 407.83 | $ 10,407.83 |

| 2 | $ 424.46 | $ 832.29 | $ 10,832.29 |

| 3 | $ 441.77 | $ 1,274.07 | $ 11,274.07 |

| 4 | $ 459.79 | $ 1,733.86 | $ 11,733.86 |

| 5 | $ 478.54 | $ 2,212.40 | $ 12,212.40 |

| 6 | $ 498.06 | $ 2,710.46 | $ 12,710.46 |

| 7 | $ 518.37 | $ 3,228.83 | $ 13,228.83 |

| 8 | $ 539.51 | $ 3,768.34 | $ 13,768.34 |

| 9 | $ 561.51 | $ 4,329.86 | $ 14,329.86 |

| 10 | $ 584.42 | $ 4,914.27 | $ 14,914.27 |

| 11 | $ 608.25 | $ 5,522.52 | $ 15,522.52 |

| 12 | $ 633.06 | $ 6,155.58 | $ 16,155.58 |

Auto-Subscription On

Staking Bonus of 61.5% for $100,000

| Month | Earning Per Month | Total Earnings | Total Yield |

| 0 | – | – | $ 100,000.00 |

| 1 | $ 4,078.30 | $ 4,078.30 | $ 104,078.30 |

| 2 | $ 4,244.63 | $ 8,322.93 | $ 108,322.93 |

| 3 | $ 4,417.74 | $ 12,740.67 | $ 112,740.67 |

| 4 | $ 4,597.91 | $ 17,338.58 | $ 117,338.58 |

| 5 | $ 4,785.42 | $ 22,124.01 | $ 122,124.01 |

| 6 | $ 4,980.59 | $ 27,104.59 | $ 127,104.59 |

| 7 | $ 5,183.71 | $ 32,288.31 | $ 132,288.31 |

| 8 | $ 5,395.12 | $ 37,683.43 | $ 137,683.43 |

| 9 | $ 5,615.15 | $ 43,298.58 | $ 143,298.58 |

| 10 | $ 5,844.15 | $ 49,142.73 | $ 149,142.73 |

| 11 | $ 6,082.49 | $ 55,225.22 | $ 155,225.22 |

| 12 | $ 6,330.56 | $ 61,555.78 | $ 161,555.78 |

A step-by-step guide to Subscribe to USDT Staking Plan on Bitcoiva?

- Click on the exchange option from the menu icon.

- Select the currency pair as USDT/INR.

- Now click on Trade, select Market, and click the wallet transfer icon.

- Choose “From Wallet” as the Main Wallet and “To Wallet” as the Spot Wallet.

- Enter the amount you want to transfer and click the “Make Transfer” button.

- You will receive a pop-up saying, “Fund has been transferred successfully.”

- Enter the total INR that you have spent to buy USDT and click on “Buy USDT.”

- Click “Yes Proceed” to get a pop-up stating, “Your order has been placed successfully.

- Click on the sell option to check your usdt balance.

- Click the Menu icon, select the Earning option, and click the Subscribe button.

- Click on the wallet transfer icon and select From Wallet as Spot Wallet and To Wallet as Earning Wallet.

- Enter the USDT amount you want to transfer and click “Make Transfer.” A pop-up will appear stating, “Fund has been transferred successfully.”

- Now, enter the amount you want to subscribe to and click the “Auto subscription on or off.”

- Note: Auto Subscribe Off: To get a 48% staking bonus with daily withdrawals. Auto Subscribe To get a 61.5% staking bonus of APY.

- Please click on the terms and conditions and then on the Subscribe button. You will receive the message “Earning Request Submitted.”

- Kindly select the swap option from the menu icon and select the currency as USDT.

- Click on the wallet transfer icon and select From Wallet as Main Wallet and To Wallet as Swap Wallet.

- Enter the amount you want to move from the Main wallet to the Swap wallet and click the “Make Transfer” Button. A pop-up will appear saying, “Fund has been transferred successfully.”

- Enter the maximum amount that you want to swap USDT from INR.

- Click on “Place Transfer” and “Yes Proceed.” You will receive a pop-up message: “Your INR has been converted to USDT successfully.” Click on OK.

- Enter the total amount you want to be subscribed for the 360-day standard USDT plan and click “Auto subscription on or off.”

- Click Please click the Terms and Conditions and click the Subscribe button. You will receive the message “Earnithe Request Submitted.”

- If you have a referral ID, enter that ID. Click on the terms and conditions and click on the Subscribe button. You will receive “Earning Request Submitted.”

- Finally, click on the menu icon and click on Logout.

How To Buy USDT on Bitcoiva?

Bitcoiva allows you to acquire usdt in three ways

- Buy USDT/INR on spot trade

- Peer to Peer transactions

- Directly deposit USDT

Step1: Sign up on the Bitcoiva Account

To stake USDT, you must create an account on Bitcoiva India’s Crypto exchange platform. You can log in with your credentials if you already have an account. Click the link below to create an account.

Step 2: Set up your Security key

First, activate your Bitcoiva account and generate a six-digit security key in Bitcoiva. Bitcoiva allows 2FA authentication and sends OTP for the registered mobile ID and phone number.

Step3: Complete the KYC process

You have to upload your bank details to complete the KYC process.

Step 4: Deposit Funds

To buy USDT, Deposit fiat currencies. Bitcoiva is the only crypto exchange in India that allows you to purchase cryptocurrencies using INR.

Step 5: Buy USDT on Bitcoiva

Your deposited funds are now in Bitcoiva’s main wallet; you must do a wallet transfer to move them to the spot wallet and buy USDT.

Enter the total amount you want to buy USDT and click buy.

FAQ

What is the APY on USDT?

If you deposit 1,00,000 usdt for 48% APY, you will get 1,48,000 with daily withdrawals at the end of the year.

What is the interest rate for USDT staking?

Earn the highest interest rate for USDT staking on Bitcoiva, the top cryptocurrency exchange in India, with 61.5% APY.

How do you gain interest in USDT?

You can earn interest on USDT via staking USDT on Bitcoiva in India to get the maximum interest rates.

Is USDT suitable for savings?

Global Savings: The USDT is universally acceptable, allowing you to save globally without worrying about time zones or hefty fees and helping you break free from traditional banking boundaries.

How do you calculate staking APY?

Bitcoiva offers the crypto staking calculator, which calculates the actual percentages, interest rates, and returns on investment of any cryptocurrencies that can be used for staking.

Is saving in USDT safe?

Saving in USDT provides stability for your funds, especially when traditional currencies experience volatility, especially during economic uncertainty.

Is staking usdt taxable?

Crypto staking is taxed as income on the fair market value of the staking rewards in INR on the day you receive them. This means that you will need to pay income tax on the value of the tokens you receive when you stake your crypto, even if you do not sell them.

Why is USDT earning so high?

As investors seek stable assets amidst market volatility, USDT has become an attractive option due to its peg to the U.S. dollar. The increased demand for USDT has led to higher interest rates on these platforms, making it more appealing for investors to hold and earn interest on their USDT holdings.

Is USDT suitable for investing?

Depending on your investment goals and risk tolerance, investing in USDT and Tether can be a good idea. Here are some pros and cons: USDT is pegged to the U.S. dollar, making it a relatively stable investment compared to other more volatile cryptocurrencies.

What does APY mean by USDT?

USDT is the symbol for Tether, a cryptocurrency pegged to the U.S. dollar. This means USDT is a stablecoin, fluctuating in value with the U.S. dollar and backed by Tether’s dollar reserves.

Where to stake USDT?

Bitcoiva is the best platform to stake USDT with high staking bonuses of 61.5% APY.

Which crypto is best for daily earning?

Satking USDT on Bitcoiva is the best way to earn daily.

Is USDT legal in India?

According to data from a trusted source, Tether (USDT) is legal for holding, buying, and trading in India. However, it is not recognized as a legal currency but as a cryptocurrency stablecoin.

Is Tether 100% safe?

While Tether (USDT) is generally considered a stable and reliable cryptocurrency, investing in it carries risks like any other asset.

Who pays the highest interest on USDT?

Bitcoiva pays the highest interest on staking USDT from 48% to 61.5% APY.

What is the APY on USDT?

The annual percentage yield (APY) is the effective rate of return on investment for one year, considering compounding interest.

What is a good APY Percentage?

A good APY percentage can be more significant than 5%.

What is 5% APY on 100,000?

A 5.00% interest rate can significantly boost your savings. Your initial $100,000 would accrue $5,000 in interest each year at this rate. But monthly compound interest would increase that total even further. At the same 5.00% rate, monthly compound interest would result in $5,116 at the end of the first year.

Who has the highest APY?

Bitcoiva, the best cryptocurrency exchange in India, offers the highest APY percentage, from 48% to 61.5% annually.

Why are APY rates so high?

Banks raise annual percentage yields on staking cryptocurrencies in a higher rate environment to attract new customers. It paved the way for competitive pressure on other crypto exchanges to increase their rates.

What does staking crypto do?

Staking is how long-term crypto investors (“HODLers”) earn passive income in the crypto world. Staking cryptocurrency means agreeing not to trade or sell your tokens. Crypto staking creates opportunities to earn crypto rewards and diversify your crypto portfolio.

Which coin is best to stake?

Stablecoins are the best digital assets to stake due to their stability in price fluctuations.

Can you withdraw staked crypto?

The protocol determines withdrawal availability and unbinding periods. You can withdraw your crypto once withdrawals are available and the unbinding period has passed.

What is the best staking platform in India?

Bitcoiva is the best staking platform in India, offering a minimum of 20% APY for all cryptocurrencies and a maximum of 61.5% APY for USDT.

How long does staking crypto take?

Lock-up Periods

Most crypto exchanges provide monthly lock-up periods with daily withdrawals compounded on yearly stakings.

Which crypto gave the highest return?

Bitcoiva, the top cryptocurrency exchange in India, offers the highest staking rewards.

What is the highest-yielding cryptocurrency?

Tether is the cryptocurrency with the highest yields in India. Bitcoiva is the top cryptostaking platforms offers high staking interests for usdt in India with 61.5% APY

Is staking excellent or bad?

Staking is a good option for investors interested in generating yields on their long-term investments who aren’t bothered by short-term price fluctuations.

Visit: www.bitcoiva.com