Introduction

Cryptocurrencies have become a cornerstone of modern finance, attracting investors worldwide with their potential for high returns and innovative technology. However, the volatility and diversity of the cryptocurrency market pose significant challenges for investors. It is where the CCI30 Crypto Index comes into play. The CCI30 Index, or the Crypto Currency Index 30, is designed to simplify crypto investments and provide a benchmark for overall market performance. This blog will delve into the intricacies of the CCI30 Index, its methodology, benefits, and real-world examples.

What is the CCI30 Crypto Index?

The CCI30 Crypto Index is a market capitalization-weighted index that tracks the performance of the top 30 cryptocurrencies by market cap. It was developed by a team of mathematicians and financial experts to provide a clear, reliable indicator of the overall health and performance of the cryptocurrency market. The index is updated monthly to reflect the most current market conditions.

Key Features of the CCI30 Index

- Market Cap-Weighted: The index is weighted based on the market capitalization of each Cryptocurrency. Cryptocurrencies with larger market caps have a more significant impact on the index’s performance.

- Monthly Rebalancing: The index is rebalanced at the end of each month. It ensures that the index remains representative of the top 30 cryptocurrencies, accounting for new entrants and removing those that no longer meet the criteria.

- Diversification: By including 30 different cryptocurrencies, the CCI30 Index provides broad exposure to the market, helping to mitigate the risk associated with investing in a single cryptocurrency.

The Methodology Behind the CCI30 Index

The methodology of the CCI30 Index is designed to provide an accurate and transparent representation of the cryptocurrency market. Here are the key components of the methodology:

Selection Criteria

The selection of cryptocurrencies for the CCI30 Index is based on market capitalization. The top 30 cryptocurrencies by market cap are chosen for inclusion in the index. However, certain criteria must be met for a cryptocurrency to be eligible:

- Market Cap: Only cryptocurrencies with a minimum market capitalization are considered.

- Liquidity: The Cryptocurrency must have sufficient trading volume to ensure liquidity.

- Exchanges: The Cryptocurrency must be traded on at least three crypto exchanges to ensure price reliability.

Weighting

The CCI30 Index uses a market cap-weighted approach. It means that each Cryptocurrency’s weight in the index is proportional to its market capitalization. For example, if Bitcoin’s market cap represents 40% of the total market cap of the top 30 cryptocurrencies, it will have a 40% weight in the index.

Rebalancing

The index is rebalanced monthly to account for market changes. It includes adding new cryptocurrencies that have risen in market cap and removing those that no longer meet the criteria. The rebalancing process ensures that the index remains representative of the top 30 cryptocurrencies.

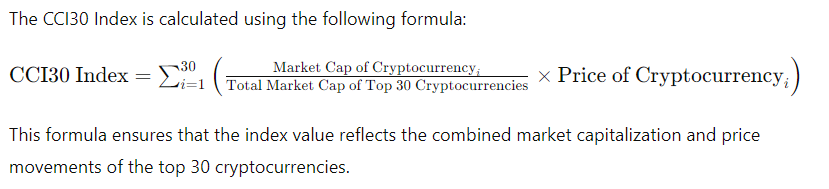

Calculation

This formula ensures that the index value reflects the combined market capitalization and price movements of the top 30 cryptocurrencies.

Benefits of the CCI30 Index

Diversification

One of the primary benefits of the CCI30 Index is diversification. By including 30 different cryptocurrencies, the index provides broad exposure to the market. It helps mitigate the risk of investing in a single cryptocurrency, as the index’s performance is not overly reliant on any asset.

Benchmarking

The CCI30 Index serves as a valuable benchmark for investors and analysts. It provides a clear indicator of the cryptocurrency market’s overall performance, allowing investors to compare the performance of their portfolios against the broader market.

Simplified Investment

The CCI30 Index offers a simplified investment approach for investors looking to gain exposure to the cryptocurrency market without the complexity of managing multiple assets. Investing in a product that tracks the CCI30 Index can achieve broad market exposure with a single investment.

Transparency

The CCI30 Index’s methodology is transparent and straightforward. The inclusion, weighting, and rebalancing criteria are clearly defined, providing investors with confidence in the index’s accuracy and reliability.

Real-World Examples

To better understand the CCI30 Index, let’s look at some real-world examples and scenarios.

Example 1: Diversification in Action

Imagine an investor, John, who wants to invest in Cryptocurrency. Instead of putting all his money into Bitcoin, John invests in a fund that tracks the CCI30 Index. By doing so, John gains exposure to the top 30 cryptocurrencies, spreading his risk across multiple assets. If Bitcoin’s price falls, the impact on John’s investment is mitigated by the performance of the other 29 cryptocurrencies in the index.

Example 2: Benchmarking Portfolio Performance

Sarah is an experienced cryptocurrency investor with a diverse portfolio. She wants to evaluate her portfolio’s performance relative to the broader market. Sarah uses the CCI30 Index as a benchmark. By comparing her portfolio’s returns to the returns of the CCI30 Index, Sarah can determine whether her investment strategy is outperforming or underperforming the market. This information helps Sarah make informed decisions about adjusting her portfolio.

Example 3: Simplified Investment Strategy

David is new to cryptocurrency investing and feels overwhelmed by the market’s complexity. He invests in an exchange-traded fund (ETF) that tracks the CCI30 Index. This ETF provides David with exposure to the top 30 cryptocurrencies without the need for him to manage individual assets. David benefits from the diversification and potential growth of the cryptocurrency market through a single investment.

Limitations and Considerations

While the CCI30 Index offers numerous benefits, it is essential to consider its limitations and potential drawbacks.

Market Cap Weighting

The market cap-weighted approach means that larger cryptocurrencies have a more significant impact on the index’s performance. It can lead to an over-reliance on a few major assets, potentially skewing the index’s representation of the broader market.

Monthly Rebalancing

The monthly rebalancing process ensures that the index remains up-to-date, but it may not capture rapid market changes that occur within the month. Investors should know this timing lag when using the index to make investment decisions.

Exclusion of Smaller Cryptocurrencies

The CCI30 Index focuses on the top 30 cryptocurrencies by market cap, excluding smaller and potentially innovative assets. While this approach provides stability, it may overlook emerging opportunities in the cryptocurrency market.

Conclusion

The CCI30 Crypto Index is a valuable tool for investors navigating the dynamic and complex world of cryptocurrencies. By providing diversification, a reliable benchmark, and a simplified investment approach, the CCI30 Index helps investors achieve broad exposure to the market while mitigating risks. Understanding its methodology, benefits, and real-world applications can empower investors to make informed decisions and optimize their cryptocurrency investments.

As the cryptocurrency market evolves, the CCI30 Index remains vital for tracking market performance and making strategic investment choices. Whether you are a seasoned investor or new to the crypto space, the CCI30 Index offers a comprehensive and transparent way to engage with the exciting world of digital assets.

Visit: www.bitcoiva.com