In the past, we have covered a wide range of technical indicators and tools to help traders. You can check them out in our trading analysis sections. And now, it is time to cover one of the most popular indicators on TradingView, moving averages (MA).

In today’s article, we will discuss what moving averages are, and how to use them in trading. Let’s get into it! But before that, you may wanna learn how to use Cryptocurrency Trading In India and how to view it.

What Are Moving Averages?

A moving average (MA) is a technical indicator that displays the average price over a predetermined number of candles. The 50-day moving average, for example, computes the average price for the last 25 daily candles. The closing price of each candle is used to do this.

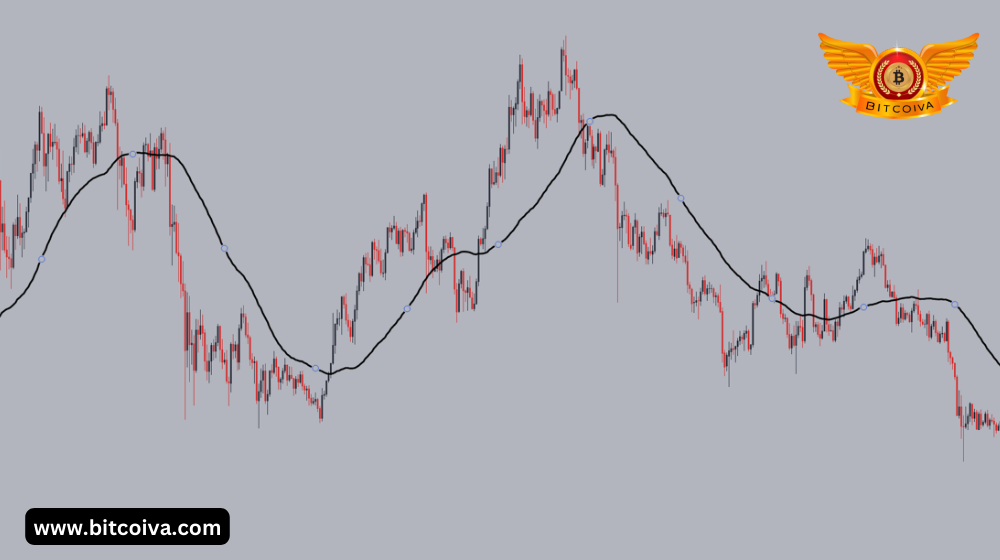

The chart below depicts World’S Largest Cryptocurrency Exchange Bitcoin’s daily 50-day moving average. As you can see, it depicts the entire Crypto India Exchange direction in a straightforward manner. The chart does this with a tiny delay because the moving average tracks the price movement. As a result, it only slopes downward when the price begins to fall. This so-called latency should never be overlooked! To reduce lag, lower timeframe charts might be utilized.

Why Do We Need MA?

Since, previously established, depict the overall direction of a trend. Shorting is often favored over yearning when the chart is moving down.

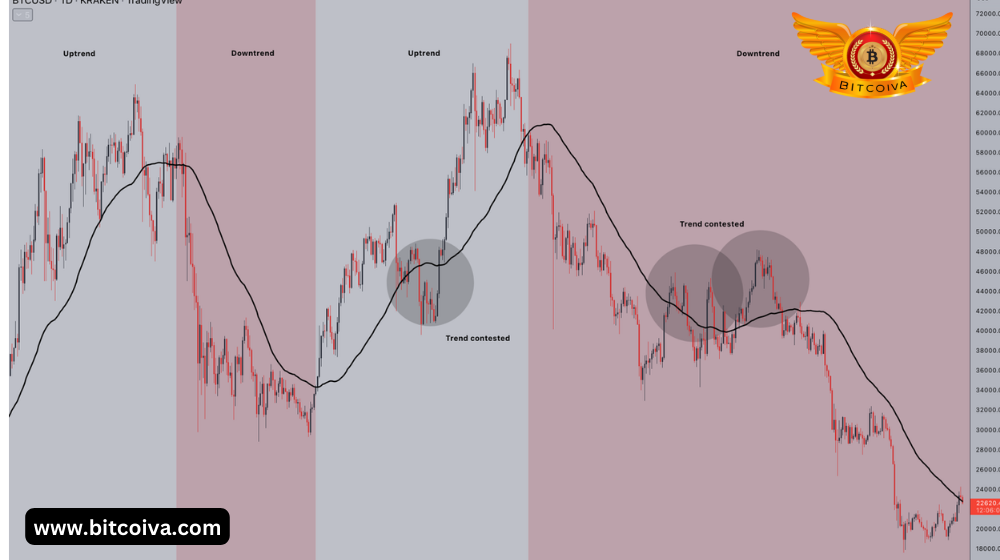

MA are curved upwards in uptrends, and the price is often trading above the MA. Short-term moving averages, such as the 15-day moving average, are higher than long-term moving averages, such as the 50-day MA.

The stronger the trend, the further the price deviates from the moving average. This condition, however, can be interpreted as a warning sign because the price frequently returns to the mean. Price trades below the MAs during downtrends. Short-term MA fall below long-term moving averages in this scenario.

The chart depicts Bitcoin’s price behavior over the previous year as well as its 50-day moving average.

It clearly demonstrates the function of moving averages and how prices revert to the average line. The grey-circled areas are instances of price attempts that failed to reverse the trend. These failures frequently lead to trend acceleration.

Can I Combine MA?

Using several moving averages might assist you in anticipating the shift between uptrends and downtrends. Long-term moving averages flatline during these transitional periods, whereas short-term moving averages cross the long-term ones. These crosses are commonly known as the golden cross and the dying cross.

How Can I Trade With Moving Averages?

MA can be used in a variety of ways in Crypto Currency Trading Platform. These are viewed as a type of dynamic support or resistance level in the first way. Traders use this approach to buy or sell retests of the moving average after it has been breached.

The moving average should ideally line up with a horizontal level, as shown in the figure below. Confluence is not needed, although it frequently enhances the possibility that the level will operate as support. Cryptocurrency Trading Sites In India allows traders to get out of these bets when the price reaches another moving average or another horizontal level.

Conclusion

Overall, a moving average is an excellent indicator for developing a deeper knowledge of trends. It can assist you in optimizing your deals. Finally, it is not a good idea to jump in when the price reaches a moving average. Your best bet is to see how it acts after it arrives and then determine whether or not to take the transaction. Wicks through a moving average, for example, can indicate whether or not the level is being met.

Visit us on : www.bitcoiva.com