The cryptocurrency market is a dynamic ecosystem, constantly shifting between Bitcoin dominance and altcoin season. Understanding these cycles can help traders and investors make informed decisions. In this blog, we’ll explain Bitcoin dominance, how it affects the market, and when altcoins shine. Buy BTC/INR and BTC/USDT in Bitcoiva, the best crypto exchange in India.

What Is Bitcoin Dominance?

Bitcoin dominance refers to the percentage of the total cryptocurrency market capitalization that Bitcoin (BTC) holds. This metric is crucial because it indicates Bitcoin’s influence over the entire market.

Formula: Bitcoin Dominance = (Bitcoin Market Cap / Total Crypto Market Cap) × 100

For example, if the total crypto market capitalization is $2 trillion, and Bitcoin’s market cap is $1 trillion, then Bitcoin dominance is 50%.

The Role of Bitcoin Dominance in Market Cycles

Historically, Bitcoin dominance fluctuates depending on market sentiment. Here’s how it typically plays out:

- High Bitcoin Dominance (>50%)

- Bitcoin leads the market, and altcoins struggle to gain traction.

- Investors see Bitcoin as a safer bet during uncertain times.

- Example: 2023 bear market, where Bitcoin dominance surged above 50% due to market uncertainty.

- Low Bitcoin Dominance (<50%)

- Capital flows into altcoins, leading to altcoin season.

- Traders seek higher returns from alternative cryptocurrencies.

- Example: Early 2021 bull run, when Bitcoin dominance dropped below 40%, fueling massive altcoin gains.

What Is Altcoin Season?

Altcoin season, often called “altseason”, occurs when altcoins outperform Bitcoin in terms of price gains. It is characterized by:

✔️ Bitcoin dominance decreasing

✔️ Massive surges in altcoin prices

✔️ Retail and institutional money flowing into altcoins

✔️ Hype around new blockchain projects and innovations

How to Identify Altcoin Season?

Several indicators help traders identify the beginning of altcoin season:

- Bitcoin Dominance Drops Below 50%

- Altcoin Market Cap Grows Rapidly

- Ethereum (ETH) Gains Strength Against Bitcoin

- Memecoins & Low-Cap Coins Skyrocket

- Increased Social Media Hype on Altcoins

Historical Example: In April 2021, Bitcoin dominance fell below 40%, triggering a major altcoin season where assets like Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA) saw all-time highs.

What Drives the Shift Between Bitcoin & Altcoins?

The shift between Bitcoin dominance and altcoin season is influenced by:

- Market Sentiment: Fear favors Bitcoin, greed fuels altcoins.

- Bitcoin’s Price Movements: A stagnant or declining BTC price often sparks an altcoin rally.

- Regulatory News: Positive or negative news can shift investor confidence.

- Ethereum & Layer 1 Growth: Strong performance in ETH often signals an altseason.

Current Market Outlook

As of now, Bitcoin dominance remains above 50%, indicating that BTC still controls the market. However, analysts predict a potential shift towards altseason if Bitcoin stabilizes and investors seek high returns from altcoins.

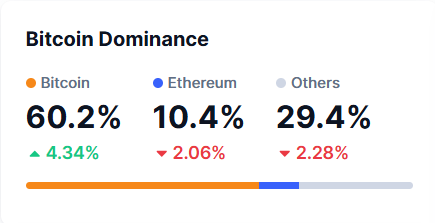

📊 Live Market Data Proof(as per Feb 5,2025): According to TradingView and CoinMarketCap, Bitcoin dominance is currently hovering around 60.2%, which means altcoins are yet to take the lead. Keep an eye on key levels below 45%, as this could signal the start of an altseason.

Final Thoughts

Both Bitcoin dominance and altcoin season play a crucial role in shaping the crypto market. Smart investors track these trends to maximize profits. Whether you’re holding BTC or looking for the next altcoin gem, staying informed is key.

Visit: www.bitcoiva.com