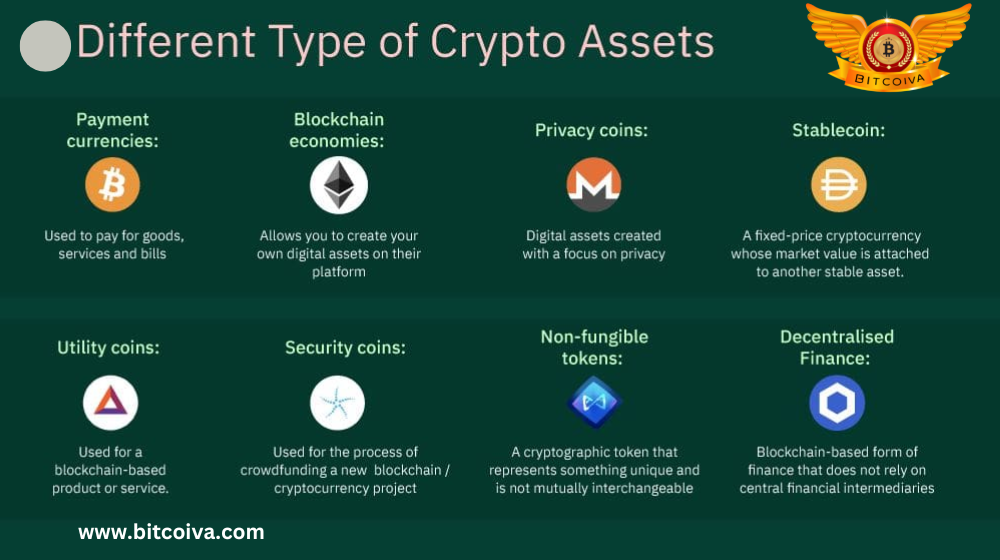

Although Bitcoin was the first cryptocurrency in operation for the general public, many different kinds of cryptocurrencies exist. This tutorial explains the various kinds of cryptocurrencies and tokens. We also provide details on the various types of cryptocurrencies, how they are used, and detailed examples of each.

Utility Tokens

Utility tokens are similar to coupons or vouchers, but they are essentially digital units that represent a value on the blockchain. In other words, the token grants access to a product or service offered by the token issuer. A person can gain access by purchasing the token and redeeming it for a set amount of access to the product or service.

The holder gains the right to a product or service worth the token’s face value but not ownership. For example, as long as they have the tokens, they can access the product or service at a reduced or no cost.

The main understanding is that they are not investment products and may completely lose value at the expense of the holder.

Utility tokens – easier to understand from a regulatory standpoint. As they are not assumed to be regulated. The token holder is not holding an equivalent of a stock, bond, or other asset governed by financial laws.

Examples: Funfair, Basic Attention Token, Brickblock, Timicoin, Sirin Labs Token, and Golem

Security Tokens

These are securitized cryptocurrencies that derive their value from an external asset that can trade as security under financial regulations. As a result, they are used for the securitized tokenization of properties, bonds, stocks, real estate, and other real-world currencies.

Because of the nature of transactions, financial regulators must control and govern their exchange, issuance, dealings, value, tokenization, backing, and trading to protect user investments.

In such a case, the regulation exists to protect user funds and investments and to hold founders accountable.

Security tokens represent a stake, share of stock or equity, voting rights, and dividend rights in the asset represented. Owners or holders profit from the actions and decisions of the issuers or managers.

They distribute via a Security Token Offering (STOs)

Their applications include situations in which investors require instant settlement, transparency in management, asset divisibility, and so on.

Access to decentralized storage in a decentralized storage network rewards tokens, and as currency for a blockchain are some of the applications.

Security tokens are further classified as follows:

Equity tokens are similar to traditional stocks in form and operation, with the exception that ownership and transfer occur digitally. Dividends are payable to investors as a result of managerial and issuer actions and decisions. Debt tokens represent short-term loans with fixed interest rates.

Asset-backed tokens: These have underlying value in the form of real-world real estate, art, carbon credits, or commodities. They have gold, silver, oil, and other characteristics.

Security tokens include Sia Funds, Bcap (Blockchain Capital), and Science Blockchain.

Payment Tokens

Payment tokens, as the name implies, are those used for buying and selling goods and services on digital platforms. It is done without the use of an intermediary, as in traditional finance and banking. Of course, the vast majority of cryptocurrencies and tokens, whether security or utility, fall into this category. However, not all utility tokens can also function as payment tokens.

The majority are hybrids of other tokens.

Payment tokens are not securities and cannot be invested in as such. As a result, they are not subject to financial regulation as asset securities.

They may or may not guarantee holders access to any current or future product or service.

Exchange Tokens

Exchange tokens – issued by and used in Cryptocurrency Exchange India. These are like crypto marketplaces for buying, selling, and swapping tokens.

Although they used outside of their native exchange environments, we primarily used them on these exchanges to facilitate token exchanges or gas utility payments.

They can be issued by centralized exchanges with or without decentralized platforms or their own blockchains.

Exchanges use them to entice people to participate in projects in order to increase liquidity.

Examples: Binance Coin or BNB token, Gemini USD, FTX Coin for FTX Exchange, OKB for Okex exchange, KuCoin Token, Uni token, HT for Huobi exchange, Shushi, and CRO for Crypto.com

Non-Fungible Token

A non-fungible token is a digital certificate of ownership to a one-of-a-kind, unique, non-replaceable item or asset on the blockchain.

With the same technology, they develop as other types of tokens. But it primarily uses to represent a work of art, photos, videos, audio, collectibles, real estate, virtual worlds, memes, GIFs, digital content such as posts, and tweets, fashion, music, paintings, drawings, pornography, academia, political items, film, memes, sports, games, or digital files of value on the blockchain.

On the Ethereum blockchain, the first NFT was created in 2015.

The digital signature design in such a way that it cannot substitute for another.

They entitle the holder to a unique item with a limited supply, originality, or edition.

Because the issues are valuable, they may be limited edition or impossible to reproduce or copy. The best NFTs are those in which only one or a few people can own an original.

It primarily assists artists, creators, and collectors in selling their wares.

They are available for purchase and sale on NFT marketplaces such as OpenSea, Rarible, Foundation, and Decentraland.

Popularity, monetizing goods, royalty payments (where artists receive a percentage of sales whenever their work sells to a new user), partial ownership of expensive assets, auctioneering to raise money (like Charmin and Taco Bell’s themed NFT auctioneering). And creating memorable moments or preserving histories, for market motives like trading, and celebrity issuing are all included in this application.

They distinguish from initial exchange offerings (IEOs). In which they are merely initial coin offerings that promote by a Crypto Exchange India.

NFT examples include Logan Paul’s video clips and Twitter co-founder Jack Dorsey’s first tweets. Mike Winklemann, also known as “Beeple,” drew NFT, EVERYDAYS: The First 5000 Days, and several crypto kitties.

DeFi Tokens

Decentralized finance refers to financial applications or dApps that build on the blockchain or distributed ledger, rendering financial and money control directly to the user while allowing them to transact on a global scale with peer-to-peer methods and access to global markets.

Anyone with an internet connection can use these DeFi apps. Token economy supports each DeFi app a token, which includes a native token. These tokens are a type of programmable money in which developers can embed logic into payment and transaction flows.

DeFi tokens currently rely primarily on the Ethereum blockchain. Other blockchains that support DeFi include Cardano, IOTA, Tron, Polygon, and Stellar.

Through these tokens, users can send and receive money, lend money, borrow money, earn interest, save money, grow and manage their portfolios. They can also invest in securities, stocks, and funds, send and receive money, trade money on decentralized exchanges, Buy And Sell Cryptocurrency In India, invest in assets, and more.

Examples of DeFi application categories: Solana, Chainlink, Uniswap, Polkadot, Aave, and many other well-known decentralized finance tokens are examples. Decentralized lending apps, decentralized exchanges, decentralized storage sharing, etc. Smart contracts, which enable anyone to define, write, program, and execute transaction rules based on specific conditions. And have transactions executed when those conditions meet, are the most important component of DeFi tokens.

Stable Tokens

These tokens are of a stable value in nature, as their name implies. It means that their value is somewhat predictable in that it essentially never changes. Stable tokens, or stablecoins as commonly known, are backed by an asset with a relatively stable value, such as fiat. So we have stablecoins that are pegged to the dollar and the euro. As well as tokens backed by commodities like oil, gold, and other precious metals.

Stable tokens assist in eradicating asset or even other digital currency volatility.

There are stablecoins that are backed by fiat, cryptocurrency, commodities, and algorithmic stablecoins, which rely on rules and software to keep their value pegged to fiat or another asset. They are backed by an asset with a defined ratio, and the asset must be held in reserves in accordance with the defined ratio.

Stablecoins include Paxos and Tether, which are all backed by USD fiat in a 1:1 ratio, along with TruSD, Gemi Dollar, and USD Coin. As stablecoins backed by gold, Kitco Gold, Tether Gold (XAUT), DigixGlobal (DGX), and Gold Coin (GLC) are also available. There are several stablecoins backed by algorithms, such as Ampleforth (AMPL), DefiDollar (USDC), Empty Set Dollar (ESD), and Frax (FRAX).

Asset-Backed Tokens

The term “asset-backed tokens” refers to a class of Crypto Trading Platform India whose underlying value supports by a real-world asset, such as cash, stocks, bonds, property, gold, and precious metals. On blockchains, they used to represent and trade the value of these underlying assets digitally.

Due to the way that transactions involving the underlying assets are conducted, the majority of these provide as security tokens. Most of them are distributed via the Equity Tokens Offer (ETO).

Depending on the issuer, any backing ratio could be used.

Examples of precious metal-backed tokens – gold-backed tokens PAXG and DGX.

Tokens backed by company shares enable the tokenization of company shares and their trading on Best Apps To Buy Cryptocurrency In India.

Examples include Slice, The Elephant Private Equity Coin, Quadrant Token (which tokenizes the Quadrant Biosciences Inc. equity), BFToken, The Dao, and RRT Token.

Oil, natural gas, renewable energy, wheat, sugar, and other commodities can tokenize and trade using tokenized commodity tokens. They also referred to as crypto commodities.

Examples of asset backed tokens include OilCoin, which tokenizes reserve oil barrels, Petroleum Coin, Ziyen Inc. Oil token, etc. The energy tokenized by the Energy Web Token (EWT), Green Energy Token by WPP, tokenization of wheat using the Wheat Token Coin etc.

Privacy Tokens

These cryptocurrencies are used for privacy applications, as their name implies. Because they have better privacy-promoting codes than Bitcoin and other Most Popular Cryptocurrency In India.

Privacy in crypto transactions is necessary for a variety of reasons. It includes the right to privacy, security investigations, and highly sensitive transactions, although they used in fraud and crime.

These cryptocurrencies use a variety of techniques, such as coin mixing, offline transactions, and anonymity methods like CoinJoin, to ensure transaction privacy. This is in addition to methods used in mainstream crypto, such as blockchain encryption and a lack of tying real names to crypto addresses.

Examples are the privacy tokens Monero, Zcash, Dash, Horizen, Beam, and Verge.

Conclusion

Here, we covered all the India Top Cryptocurrency Exchanges. We have listed 9 popular types of cryptocurrency for those who are wondering how many different kinds there are. The most common cryptocurrency types are payment tokens.

Security tokens are the best to invest in based on these categories. Although all payment tokens are ideal for that use. Only that there is no one to hold responsible if an investment is a failure. Because utility tokens are not supported by regulation.

If it were a scam, everyone would be aware of it before it got very far. The majority of utility token projects succeed in the market by honoring their commitments to investors because doing so directly influences demand and usability or utility.

Visit us on : www.bitcoiva.com

Comments are closed.